Prepare for a career in industry or business after your chemistry degree using this self-study resource for undergraduates

As a chemist, you can already bring a lot to the world of business, from your subject knowledge and technical training to your experience of research and analysis. But if you want to pursue a career in industry or commerce, what should you know about marketing, intellectual property or finance? And what skills are essential for working in business?

This self-study resource is designed to help you develop the skills and understanding you need to thrive in a commercial role. Whether you’re passionate about working as a chemist in a specialised industry context, or want to explore opportunities in business outside chemistry, use this resource to:

- Improve your knowledge of finance, regulations, intellectual property and quality assurance

- Explore the marketing ‘mix’ and learn how to create an effective strategy

- Gain insight into startups, spinouts and how new businesses plan for growth

- Identify and develop key business skills, from productivity and planning to communication and creativity

Practise and apply what you learn through exercises based on a variety of business scenarios and real life case studies, and discover tips to help you further develop your skills and experience alongside your degree.

What’s on this page

- Using this resource

- From university to business: tips and suggestions

- What do chemists do in business and industry?

- What business skills do I need?

- Money and finance

- Ideas and intellectual property

- Regulations

- Quality assurance and control

- Marketing

- Startups and spinouts

- Practice scenarios

- Notes for tutors

1. Using this resource

Business Skills and Commercial Awareness for Chemists is designed to help you develop the skills and understanding you need to pursue a career in business or industry. You will explore things it’s useful to know about business (commercial awareness) and things it’s important to be able to do effectively (business skills).

Read on to find out how to get the most out of this resource, or explore some chemistry-related industries to start thinking about roles and sectors that might interest you.

1.1. What topics can I learn about?

To help you develop your commercial awareness, the materials cover six key topics relevant to many different roles and commercial contexts, including:

- Money and finance

- Ideas and intellectual property

- Regulations

- Quality assurance and control

- Marketing

- Startups and spinouts

Each topic has a general introduction and links to selected resources to read more widely about the issues. There are also a number of video contributions from people working in industry, offering personal perspectives on what it helps to know about business early in your career.

Using presentations in this resource

Some topics feature downloadable Powerpoint presentations. Each presentation is accompanied by a guide which explains the material and provides instructions on how to navigate the slideshow. You will need to start the presentation (in Powerpoint, click ‘Start from Beginning’ or press F5) and continue to click when prompted by the guide (‘click 1’ means ‘click for the first time’, ‘click 2’ means ‘click for the second time’ and so on).

1.2. How can I practise and apply what I learn?

When it comes to business skills, practice is essential. This resource includes a range of activities designed to help you apply what you learn and practise key skills.

Try short exercises linked to individual topics, or for a greater challenge explore the four scenarios available for download. Each scenario puts you in the position of justifying a significant business decision. It is the way you make this decision that provides the opportunity to reflect on and develop your business skills.

Launching lemon bleach

For each topic, you will find at least one exercise that relates to an imagined business opportunity surrounding ‘lemon bleach’. This is intended to mimic a situation where a discovery you have made lends itself to potential commercialisation. In this case, you have identified some unique fragrance ingredients that offer the possibility of a new range of distinctive household cleaning products.

As you work through each of the business topics, you will build up a more complete picture of all the things you would have to engage with if you wanted to launch lemon bleach as a product, including:

- Calculating costs

- Trademark design

- Searching for patents

- IP protections

- Complying with regulations

- Developing quality control procedures

- Preparing a marketing strategy

At this stage, you would be in a position to produce a business plan, especially if you had explored the links and guidance on producing effective business plans in the Startups and spinouts section. In fact, producing such a business plan is a major outcome of each of the four practice scenarios, and drawing together the component strands of the lemon bleach business opportunity forms one of these.

Download the guidance notes for the lemon bleach scenario now, or explore the other practice scenarios included in this resource.

2. From university to business: tips and suggestions

The materials in this resource are designed to give you an overview of commercial awareness and key business skills. You can build on what you learn here by following industry news, taking advantage of support available at your institution and, where possible, seeking opportunities to do part-time or voluntary work.

2.1. Building a skills plan

Higher education can offer significant opportunities to supplement the business skills and awareness you begin to acquire here. Many institutions provide a range of courses and seminars on communication, teamwork, and even more business-specific topics such as finance and enterprise.

- Explore your institution’s website and write down a list of the courses, seminars and workshops available to you that will reinforce your business skills.

- Think about the wider opportunities available to you (part-time jobs, volunteering, business competitions etc) that might give you the chance to develop your business skills and commercial awareness. Write down a list.

- List all the courses, activities, hobbies and employment you have already completed that have helped you gain useful skills for business or develop your awareness of the topics covered by this resource.

- Plan your next steps by prioritising the options available to you. Rank the courses, activities and opportunities you have identified in order of priority and set timeframes and SMART goals for each of them.

Explore industry and business news with Chemistry World

Whether you’re interested in pharmaceuticals, technology or food, follow chemistry-related business news and analysis with Chemistry World online.

Registration is quick and completely free.

3. What do chemists do in business and industry?

Chemists find roles in a wide range of business environments, much wider than traditional destinations such as the heavy chemical industry, petrochemicals and pharmaceuticals. The range of sizes of business spans everything from organisations with teams of chemists to others where there might be a single qualified chemist. In this section, you will explore the past, present and future of chemistry-related industries, and find out more about what you could do as a professional chemist.

Discover a future in chemistry

You can find further information and support, including career ideas, case studies and job profiles, at the Royal Society of Chemistry’s careers website, A Future in Chemistry.

3.1. The history of the chemical industry

In the 19th and 20th centuries, the chemical industry developed rapidly in response to the attendant social needs of industrial revolution, population growth and shifts in geo-political and economic pre-eminence. Technological developments generally proceeded in advance of detailed scientific understanding, perhaps in contrast to modern and future chemical industry developments where fundamental scientific breakthroughs are creating new business opportunities.

Find out more

- David J. Rowe’s survey of the history of the chemical industry from 1750 to 1930 links the emergence of the chemical industry in Britain with key political, social and scientific developments.

- For an alternative, more global perspective, try Johann Peter Murmann’s comprehensive article on the chemical industries after 1850.

Exercises

- Using Rowe’s article, list examples of technologies that have been exploited commercially long before the fundamental science underpinning them has been understood. List examples of businesses that have followed on directly from fundamental scientific discoveries. Search the internet to put dates against the technologies involved. Is it true to say that the trend is now increasingly for scientific discovery (research) to precede commercial development?

- Search the internet for more information on the history of the chemical industry. Make notes on the key developments that you find.

Further reading

- A. Heaton, An Introduction to Industrial Chemistry, Blackie, Glasgow, 1996.

- A. Heaton, The Chemical Industry, Blackie, Glasgow, 1996.

- The Essential Chemical Industry, CIEC, University of York, 2013.

3.2. The chemical industry today

The chemical industry continues to evolve while facing important challenges, from declining supplies of raw materials to increasing environmental sensitivity and the impact of global climate change. The following resources provide more information about the chemical industry today.

Find out more

The European Chemical Industry Council (CEFIC) publishes a variety of reports and resources on the relative size, scope and composition of the European chemical industry, as well as providing information on sustainability initiatives. For example:

- The 2023 Facts and Figures of the European chemical industry report compares the European chemical industry to the rest of the world and includes information about market share, industry production and contributions to other EU industries.

- The 2020 CEFIC Sustainability Progress Update reflects on the chemical industry’s ongoing role in transitioning to ‘a safe, resource efficient, circular, low-carbon society’.

ICIS, a chemical market information supplier, publish an annual list of the Top 100 chemical companies in the world, together with a general overview of the current state of the chemical industry. (You can download reports like the Mid-year Global Review and H2 Trends by registering for free on the ICIS website.)

Exercise

Explore some of the companies in the Top 100 to see what their speciality is and what makes them successful. You could also check their careers sections to get an idea of which specialist skills are in demand.

3.3. Choosing a career in chemistry

Professionals formally trained in chemistry-related disciplines can be found in different walks of life in terms of industry sectors, eg from flavour and fragrance to waste management, and in terms of positions, eg a lab scientist or an editor. You can find examples of chemistry graduate careers and job roles on the University of Warwick and University of York websites.

You may already have a specific chemistry career in mind but, even so, it is still instructive to take a look at what kinds of things chemists currently do. If you’re less certain about your immediate future, try exploring some of the job profiles from the RSC’s A Future in Chemistry, or take a look at the American Chemical Society’s College to Career resources.

You may also wish to refer to your own university’s Careers/Employability facilities for more information about careers in science, whether you want to gather more information on a particular career or explore what is available to you.

Exercises

- Write down a list of chemistry industry careers that particularly appeal to you. Write down what you think each role entails then search the internet and see if the information you find confirms your expectations.

- How long have the roles you wrote down existed within the industry? What historical factors have caused the roles to evolve into their current form?

3.4. The future of chemistry-related industries

The chemical industry is dynamic and forecasting future trends is no easy task. However, such predictions are vital for industry professionals, investors and policy makers, not least where training and education of the future workforce is concerned.

Find out more

KPMG are a tax and auditing firm who produce detailed forecast reports on many different market sectors, including the chemical industry. Explore their reports and resources on the chemicals sector to get an idea of the challenges the industry will face over the next few years, and how they will affect the state of the chemical market and its individual players.

Exercises

- In the previous section, you wrote down a list of chemical industry careers that appeal to you. What current and impending factors do you think are impacting on those roles? (You may need to search the internet to find more about key issues affecting the industry.)

- If you are already working within the industry, on placement for example, what are the key issues affecting the future of the business of your host company?

4. What business skills do I need?

As a student, you’re probably familiar with lists of key personal, transferable and study skills. However, when you hear the phrase ‘business skills’, a different combination of expertise and competencies might come to mind.

You might think ‘business skills’ are the skills you need to run a business. For some people, this might have more to do with accounting and financing or an in-depth knowledge of the stock market, while for others it might mean the know-how required for marketing and selling products. The more pessimistic among us might even think it means having a natural entrepreneurial talent that can’t be taught or learned.

If you’re a chemistry student planning to work in a lab in academia or industry, you might feel you don’t have much use for these mystical business skills anyway. But it’s hard to make a judgment on the usefulness of business skills without defining them first.

4.1. What are ‘business skills’?

If you’re struggling to define what business skills are, you’re not alone. Whilst all are agreed that employees with good business skills are essential to the effective running of a business, different people have quite varying views concerning just what exactly they consist of.

If you search online for what business skills are, you’re likely to come across some or all of the skills in the table below, which seem to resonate with the views of most people.

| Communication | Planning |

|

Written communication Social networking Speaking Sales Negotiation |

Strategic planning Project management Financial planning Risk management Logic |

| Productivity | Creativity |

|

Time management Meeting coordination Systems skills Leadership Personal productivity |

Imagination Inventiveness Problem solving Brainstorming Making connections |

4.2. What skills do chemistry graduates find most useful?

The skills we’ve just listed are consistent with the type of language used by management and industry, but they are still fairly close to those found on most transferable skills lists.

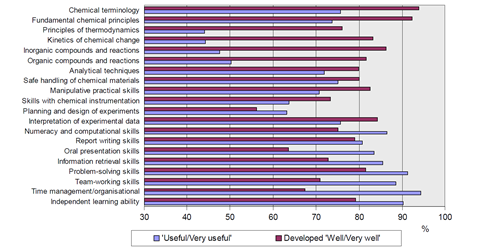

The strong overlap between transferable skills and what might be identified as business skills was reinforced by the 2010 survey, ’Skills Required by New Chemistry Graduates and Their Development in Degree Programmes’, conducted by the Higher Education Academy with the support of the Royal Society of Chemistry.

This report also showed that the majority of chemistry graduates found these transferable/business skills were more important, and less developed, than their in-depth knowledge of chemistry when they started their careers in chemistry or other industry. In fact, they rated these skills as more important that an in-depth knowledge of chemical terminology, and even analytical techniques.

4.3. What skills do businesses value?

We asked some representatives from chemistry-related businesses to tell us what skills they found made the most employable graduate chemists, and which skills are essential as opposed to beneficial. The relevant business skills as identified by the respondents are shown in the table below.

| Communication | Interpersonal skills |

|

Networking and communication skills Teamwork Effective written communication (email, summarising results) |

Cultural awareness Working with and motivating people with different personality types Working effectively with people from diverse backgrounds and organisations |

| Productivity and planning | Creativity |

|

Influencing and leadership Managing people Research planning Time management |

Making connections Effective problem definition Flexibility |

Some interesting ‘skills’, which are more related to commercial awareness of the chemical industry, were also flagged as very important by the same respondents, with some more specialised than others. In addition to general business awareness, these ‘skills’ included knowing about:

- Basic finance

- Company funding

- Legilsation and economics

- How clinical trials are funded

- The development and application of intellectual property

- The structure, function and implications of patents

- Knowledge of state-of-the-art technologies

This demonstrates how difficult it can be to distinguish clearly between generic transferable skills and knowledge of the inner workings of the industry, because a good industrial chemist should be well developed in both areas. Although the need for transferable skills is no different from any other sector, the uniqueness of the chemical industry, and therefore the situations in which these skills will come in handy, require a good understanding of the whole industry.

Hear from industry experts

Exercise

In Choosing a career in chemistry, you wrote down a list of chemical industry careers that appeal to you. Which areas of skills and business awareness do you think are most important in each of those roles? How do you rate your current skills and awareness in these areas at present?

5. Money and finance

Just as there are carbon and nitrogen cycles in nature, there is a cycle of money in any business or organization. Knowing how this cycle works and maintaining a ‘healthy’ flow of money within it will ensure the long-term success of the business, and delivery of projects on time and within budget.

This topic aims to give you a basic understanding of how to keep track of finances – ie incomings and outgoings – and the most widely used tools to accomplish this.

5.1. Micro- and macro-economics

Economics was defined by Lioniel Robbins in 1932 as ‘a science which studies human behaviour as a relation between ends and scarce means which have alternative uses’.

Throughout this topic, you will cover key concepts within the field of market economics and the management of financial resources within an organisation. This is known as ’micro-economics’, as opposed to ‘macro-economics’, which covers more general industry-wide, national and international issues.

While this resource focuses on micro-economics, we encourage you to read widely about economics in general and its particular relationship with the chemical industry.

Suggested reading

- W. F. Samuelson and S. G. Marks, Managerial Economics, Wiley, 2014.

- W. B. Allen, K. Weigelt, N. A. Doherty and E. Mansfield, Managerial Economics, Norton, New York, 2012.

- D. Gowland and A. Paterson, Microeconomic Analysis, Haverster Wheatsheaf, London, 1993.

- A. Heaton, An Introduction to Industrial Chemistry, Blackie, Glasgow, 1996.

- A. Heaton, The Chemical Industry, Blackie, Glasgow, 1996.

5.2. Hear from industry experts

5.3. Cost centres

It is very important for an organisation to control its costs and in order to do this it must collect and manage as much cost information as possible. Financial management systems are usually set up around ‘cost centres’.

The Institute of Chartered Management Accountants defines a cost centre as ‘a location, function or item of equipment in respect of which costs may be ascertained and related to units costs’. A cost unit is defined as ‘a quantitative unit of product or service in relation to which costs are ascertained’.

A hierarchy of cost centres is often used to gather costs in an increasing level of detail.

Exercises

- Browse the internet using the key words ‘cost centre’, ‘cost unit’ and ‘cost management systems’ and make your own notes on what you find.

- Make a list of possible cost centres within an organisation you are familiar with, for example your employer, your educational establishment or your charity. Link the possible cost centres into a hierarchical tree, with the whole organisation at the top and the smallest appropriate, manageable, cost units at the bottom.

5.4. Cost types

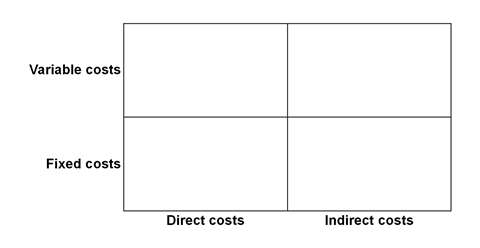

Within the chemical and other process industries in particular it is helpful to categorise costs in two main ways.

Variable and fixed costs

One approach to categorising costs is to express them as either ‘variable’ or ‘fixed’.

A variable cost is a cost item that is related to the quantity of product manufactured and is expressed in units of money per amount eg £t -1 (where t is a metric tonne or 1000 kg). Examples of variable costs are raw materials, solvents, homogeneous catalysts, energy and water.

A fixed cost is a cost item that is not related to the quantity of product manufactured and which has to paid in full at the start or during production and is expressed in units of money per time period eg £ a -1 (where a is per annum or year). Examples of fixed costs are labour charges, administrative overheads, central R&D expenditure.

Direct and indirect costs

Another way to categorise costs is to express them as either ‘direct’ or ‘indirect’.

A direct cost is an item that is incurred specifically to manufacture the product, such as raw materials, production equipment and labour charges.

An indirect cost is an item incurred not specifically for the product in question but elsewhere within the company, such as central management or the human resources department.

Exercises

- Browse using the key words, ‘variable cost’, ‘fixed cost’, ‘direct cost’ and ‘indirect cost’ and make some notes on what you find.

- These two approaches to categorising cost types may be linked within a 2 x 2 matrix, as shown below. Populate the four matrix boxes with as many different examples of cost items as you can suggest.

5.5. Cost equations

When the individual costs of a business have been identified and categorised into fixed or variable they can be added together and used to prepare cost equations. A cost equation shows the relationship between the costs and the quantity of product manufactured.

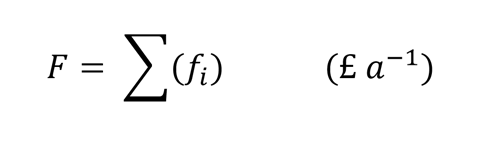

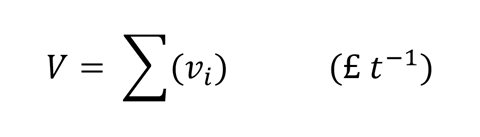

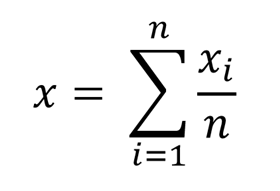

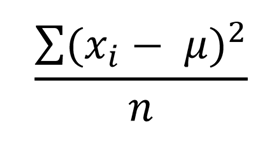

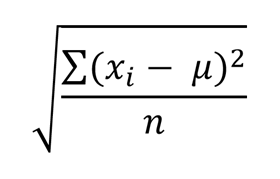

Let the quantity of product manufactured be x, which will be expressed in units of amount per time period eg tonne/annum. If each fixed cost is represented by f i (where i is 1 to the total number of fixed cost items) then the total fixed cost F will be:

If each variable cost is represented by v i (wherei is 1 to the total number of variable cost items) then the total variable costs will be:

The fixed and variable costs may be combined to derive cost equations.

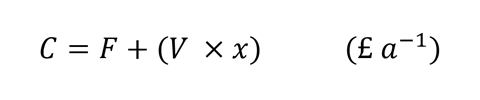

Total cost (C) equation

A total cost equation is the sum of all costs associated with manufacturing the product:

Average cost (AC) equation

An average total cost equation is the total cost of manufacture divided by the quantity manufactured:

In other words, average total cost = average fixed cost + average variable cost.

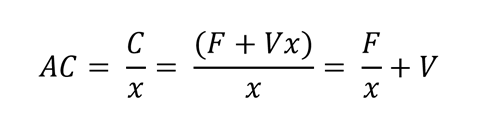

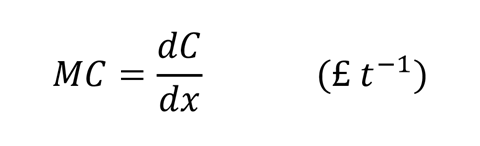

Marginal cost (MC) equation

A marginal cost is the cost of producing one extra unit of product than is currently produced. For example if 10 units cost a total of £100 to manufacture and 11 cost a total of £105 to manufacture then the marginal cost of producing the 11th unit is £5.

Marginal cost is the small change in cost for a small change of quantity manufactured at a given point along the total equation, hence may be defined algebraically as:

In other words, the marginal cost equation is obtained by differentiating the total cost equation.

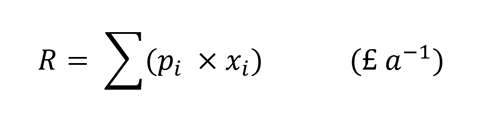

5.6. Revenue equations

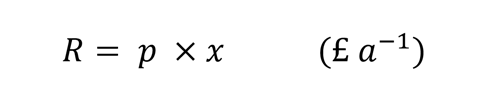

After the products are manufactured they will be sold into a market at a price per unit p. The total amount of money received is termed the revenue R. If the price of each product item is represented by pi (where i is 1 to the total number of product items sold x) then the total revenue R will be the price multiplied by the quantity:

The price and quantity of products sold may be used to prepare total revenue and marginal revenue equations.

Total revenue (R) equation

A total revenue equation shows the relationship between the revenue and the quantity of product manufactured:

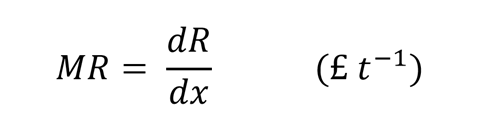

Marginal revenue (MR) equation

A marginal revenue is the extra money received from selling one extra unit of product than is currently sold. For example if 10 units are sold for a total of £100 and 11 units sold for a total of £105 then the marginal revenue of selling the 11th unit is £5.

Marginal revenue is the small change in revenue for a small change in quantity sold at a given point along the revenue equation, hence may be defined algebraically as:

In other words, the marginal revenue equation is obtained by differentiating the revenue equation.

5.7. Profit equations

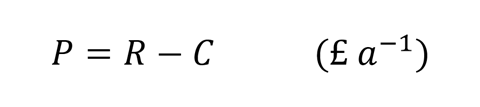

The profit P is defined as the difference between the revenue and the costs for manufacturing a product. A number of different profit measures may be determined, including full profit and gross margin.

Full profit (P) equation

The full profit equation is the total revenue minus the total costs:

A company will aim to maximise the profit for a given product by maximising the revenue and minimising the costs.

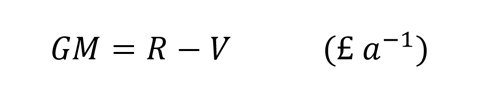

Gross margin (GM) equation

A profit measure used extensively within the chemical industry is gross margin, which is defined as the total revenue minus the variable costs:

The gross margin will allow the profitability of the production plant to be judged without the involvement of central overhead fixed costs. Central overheads are usually allocated to a production cost centre by the main company hence beyond the control of the local production manager. A production manager that maximises the gross margin of the product will maximise the amount of money that can be contributed towards company fixed overheads.

Exercises

- Browse the internet using the key words, ‘total cost equation’, ‘average cost equation’, ‘marginal cost equation’, ‘marginal revenue equation’, ‘profit’ and ‘gross margin’. Make you own notes on what you find.

- Suggest as many different reasons as you can why an organisation would want to maximise profit.

- The best way to learn about cost equations is to practise using them. Download this cost equation example worksheet to attempt to derive a cost equation for a process.

- As you will be aware, the scale of production can have a dramatic effect on the unit cost of a product. Explore the linear cost equation description of this observation for a Friedel–Crafts alkylation process in this worksheet.

- Some cost calculations are less straightforward, such as where the capacity of chemical plant influences the cost of an operation leading to non-linear cost equations. Try this non-linear cost equation worksheet to practise working with these more complex calculations.

5.8. Demand and supply

When a company offers a product for sale into the marketplace many factors will influence the quantity of the product that will be sold. The demand for a product in a given market may be defined as ‘the quantity q of a good or service that will be bought at a specific price p in a given period of time’.

The relationship between the quantity and price is termed the ‘demand function’.

Exercise

Make a list of as many different parameters as you can think of that will have an influence on the quantity of a product that will be demanded by customers in a market.

Demand equation

We can generate a demand equation relating the price and quantity of a product in a given market. However, this can only be done by offering the product for sale into the market at various prices and recording the quantity sold. In this way, a demand schedule may be built up and the demand equation determined.

An example of a demand schedule is shown in the table below.

| Selling price (£ kg-1) | Quantity sold (kg) |

|---|---|

| 10 | 0.0 |

| 9 | 0.7 |

| 8 | 1.5 |

| 7 | 2.4 |

| 6 | 3.4 |

| 5 | 4.6 |

| 4 | 6.1 |

| 3 | 8.5 |

| 2 | 13 |

| 1 | 19 |

The demand schedule shows that if the product is offered for sale at £9 kg-1 only 0.7 kg will be sold whereas if it is offered for sale at £2 kg-1 then 13 kg will be sold.

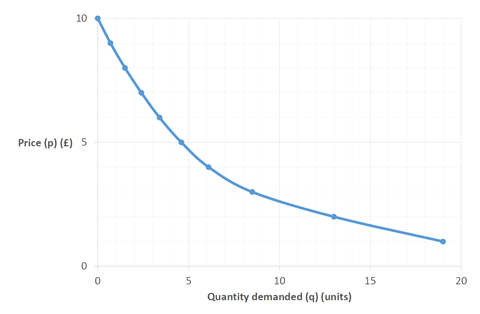

A graph of price against quantity may be plotted as shown below and the equation of this curve is the demand equation.

The general features of a demand equation are that it is a downwardly sloping curve – ie it has a negative gradient – and that there is an upper price limit.

Exercises

- Browse the internet using the key words ‘demand function’ and ‘demand schedule’ and make your own notes on what you find.

- Try this simple activity to explore demand schedules further.

Supply equation

Complementary to the demand function is the supply function. The supply function is defined as ‘the quantity q of a good or service that will be offered for sale at a specific price p in a given period of time’.

Exercise

Make a list of as many different parameters as you can think of that will have an influence on the quantity of a product that will be supplied by a company into a marketplace.

An example of a supply schedule is shown in table below.

| Selling price (£ kg-1) | Quantity prepared to be sold by manufacturers (kg) |

|---|---|

| 10 | 25 |

| 9 | 24.2 |

| 8 | 23.2 |

| 7 | 21.8 |

| 6 | 20 |

| 5 | 18 |

| 4 | 14 |

| 3 | 8 |

| 2 | 0 |

| 1 | 0 |

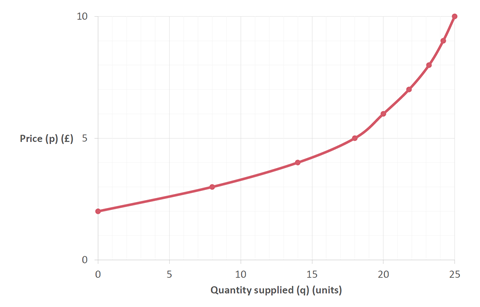

The higher the price in the market the more product will be supplied by manufacturers because it is more profitable. Hence a supply function is always an upwardly sloping curve, as in the graph below, with a threshold price below which all manufacturers would make a loss so they will not supply product.

Exercise

Browse the internet using the key word ‘supply function’ and make your own notes on what you find.

5.9. How much product should an individual company supply to a market?

This is an interesting question and may be answered by a consideration of the cost equations for each manufacturer. Download this presentation on market supply to find out more, using the guide below.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- Every manufacturer will have their own unique cost structure hence their own average cost (AC) and marginal cost (MC) equations (see Cost equations).

- If the price of the product in the market is p1 then the demand equation faced by the company will be flat and constant at p1 (see Perfect markets) (click 1). The demand equation will also be the same as the marginal revenue equation (see Perfect markets).

- The company will wish to maximise profit by operating at the position where MC = MR (see Cost equations) so will supply a quantity q1 at the price p1 (click 2).

- If the price in the market changes to p2 then to maximise profit the company will supply quantity q2 (click 3).

- If the price in the market changes to p3 then to maximise profit the company will supply quantity q3 (click 4).

- If the price in the market changes to p4 then to maximise profit the company will supply quantity q4 (click 5).

- If the price in the market changes to p5 then to maximise profit the company will supply quantity q5 (click 6). However, this maximum profit is actually a minimum loss because the costs are above the revenue so in order to not make a loss the company will stop supplying product at any quantity below that of the minimum of the average cost curve.

- In conclusion, the supply curve for the company will be the same curve and same algebraic equation as the average cost AC curve at all quantity levels above that of the minimum of the AC curve (click 7).

- A similar analysis will apply to every company in the market and each company will have their own individual supply curve. Note that the quantity supplied by an individual company is given the letterx while the quantity supplied in a whole market is given the letter q. These are related by the number of companies n supplying the market.

- A market supply curve is obtained by adding together individual supply curves in a process of ‘horizontal summation’ (click 8).

5.10. Perfect markets

A perfect market model is similar in concept to the perfect gas equation: many assumptions are made and the model has limited use in practice. However, the features of a perfect market model are often shown within markets and the analysis can be useful as a guide.

The main assumptions made within a perfect market model are:

- The product sold is homogeneous, ie all participants sell to an identical specification.

- All participants aim to maximise their profits.

- There is a large (infinite) number of buyers and sellers within the perfect marketplace.

- Every participant has perfect knowledge about the product, ie its production and use.

- There are no barriers for participants to enter or leave the perfect marketplace, eg financial, production capacity, patent protection.

- The quantity of product sold by an individual company into the perfect market is very small compared to the total market size.

- There is no economic friction, ie import barriers, government trade restrictions.

Exercise

Make a list of products or services you think are close to a perfect market scenario. Browse the internet to identify possible examples.

5.11. Perfect market analysis

Download this Powerpoint presentation to find out more about using perfect market models, referring to the guide below to follow the analysis.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- Begin with a blank graph of price p against quantity q. Note the quantity in the whole market is defined as q.

- Within a perfect market there will be a demand curve set by the behaviour of the customers. The market demand curve will be a downwardly sloping curve (click 1).

- The supply curve will be a horizontally summation of the supply curves for each of the many small producers in the perfect market. The market supply curve will be an upwardly sloping curve (click 2).

- The intersection of the demand and supply curves will represent the optimum price and quantity within the perfect market and is termed the ‘equilibrium price’ (click 3) and ‘equilibrium quantity’ (click 4).

- The equilibrium price and quantity will change rapidly in response to changes in the market. If the demand curve increases from D1 to D2 then the equilibrium position will change to E2 (click 5). If the supply curve then decreases from S1 to S2 then the equilibrium position will change to E3 (click 6).

- So the prices and quantities will be determined by market forces and individual companies will be ‘price takers’, in other words they will have to accept the price set by the market (click 7).

Exercise

Search the internet using the key words ‘perfect market model’ and ‘price takers’. Make your own notes on what you find.

5.12. Analysis for individual companies within a perfect market

Download and open this presentation on perfect market pricing and use the guide below to learn how to analyse individual companies within a perfect market model.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- Each company in the perfect market is assumed to have a similar cost structure, as shown in the graph of the average cost curve and the marginal cost curve.

- Assuming the equilibrium price in the perfect market is p1 then because each company is a price taker they will be faced with a demand curve of constant price whatever amount they manufacture (click 1).

- A constant demand curve will mean that the marginal revenue curve is also constant and identical (click 2). Can you prove this algebraically starting with a demand equation of p = q, then forming a revenue equation, then determining a marginal revenue equation?

- The profit maximisation point for the individual company will be at the position MC = MR and therefore this will be the quantity q1. The company will make a profit as this price is above the average costs (click 3).

- If the price then drops to p2 in the market the MC =MR position will move to price p2 and quantity toq2 and the company will break even as now the price = average costs (click 4).

- If the price then drops to p3 in the market the MC = MR position will move to price p3 and quantity to q3 and the company will be making a loss, hence the company will withdraw from the perfect market (click 5). However as companies withdraw because the product is not profitable then the overall market supply will decrease hence the market equilibrium price will increase, which will encourage companies to enter the market again.

- Therefore the perfect market will be in a constant state of flux as demand and supply curves change and companies enter and withdraw from the market.

Exercise

Test your understanding by working through this worksheet on calculations relating to a perfect market model.

5.13. Monopoly markets

There are many reasons why a perfect market structure will tend not to exist in practice, such as:

- Some companies will operate a larger production plant hence will have economies of scale and a lower cost basis.

- Not all products will be identical, some will have a slightly higher specification or be branded.

- Supply and demand may not be regular.

- Customers will often behave irrationally.

- Not all firms in a market aim to maximise profit exclusively due to their aims or culture.

- Knowledge of a product or its applications is not costless.

- Collaboration or collusion (often illegal) exists between producers and customers.

One example of an imperfect market is a monopoly. In this market structure the following assumptions are made:

- There is a single supplier, although in practice a market with a dominant player (above 25% market share) will often exhibit monopolistic tendencies.

- There is one, homogeneous product and no substitutes are available.

- The product is sold at a single price.

- The supplier aims to maximise profit.

- The demand function is still valid, as a single supplier cannot force a customer to buy the product.

A monopoly market structure is considered anti-competitive in most countries and legislation is in place to control or limit the negative effects.

5.14. Monopoly market analysis

Download this Powerpoint presentation and use the guide below to explore the analysis of a monopoly market.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- The starting point of this analysis is a graph of the cost curves facing one of the many companies in a perfect market (see Perfect markets) (opening slide). The graph shows the marginal cost curve for the company and as it will be price taker (in a perfect market) it will face a constant demand curve at price p1. The marginal revenue MR curve is identical to the demand curve. Hence the profit maximisation position is where MC = MR at quantity q1 (click 1).

- However, if this company was to build a large scale production plant and manufacture sufficient product to supply the whole market it would be able to dictate the price and quantity available in the market. Hence the company would become a monopolist and a ‘price setter’ and would be faced with the whole market demand which is a downwardly sloping curve (see Demand and supply) (click 2).

- In this situation the marginal revenue MR curve is not now identical to the demand curve as it will show a steeper gradient (click 3). You can demonstrate this by starting with a demand curve represented by the equation p = 5 – 2q, rather than a perfect market constant price demand equation of p = 5. Now determine the revenue R equation which is obtained by multiplying price by quantity, where the price is now given by the demand equation. You should derive an equation for the revenue as a function of q. Now determine the marginal revenue MR equation by differentiating the revenue equation (dR/ dq), to obtain MR = 5 – 4q, ie a similar curve to the demand equation but with a steeper gradient.

- In this monopoly situation the company will want to maximise its profits by operating at MC = MR, which is now at quantity q2 (click 4). Therefore once a monopoly has been formed the monopolist will probably want to maximise profit by raising the price to the customers (and accordingly will have to lower the quantity supplied to match the demand curve), which of course is bad news for the customers.

- The position q3 is the location of maximum revenue for the company, can you prove this algebraically? (click 5). (Hint: how can you determine the maximum or minimum point of a curve using calculus?)

- The monopoly situation is repeated on the next slide (click 6). However, because the company has built a very large manufacturing plant to cover the whole market it will be able to take advantage of economies of scale hence will experience lower unit costs. Therefore its marginal cost curve will be lower than it would be for a small producer in a perfect market (click 7). The position of profit maximisation MC = MR (click 8) will now be at quantityq4 hence at price p4 (click 9). This situation is termed a ‘natural monopoly’ (click 10) and will result in a lower price (and accordingly higher quantity supplied to match the demand curve) for the customers, which of course is good news for the customers.

- Due to the large amount of money needed to build and operate a chemical plant it makes good sense for all concerned to build larger plants to take advantage of economies of scale rather than build many small plants. Therefore the chemical industry in particular has a tendency to form a natural monopoly, at least localised within countries or regions.

Exercises

- Browse the internet using the key words ‘natural monopoly’. Make your own notes on what you find.

- Consider the advantages and disadvantages of allowing a monopoly to exist within an industry. Perhaps conduct a debate with a group of colleagues with one taking the stance that a monopoly is good and the other taking the stance that a monopoly is bad. As part of this exercise, gather background information on the legislation in force concerning a monopoly. Consult the pages on the UK government website covering the Competition and Markets Authority, and consider the role of patents (see Ideas and intellectual property).

- Check your understanding by working through this worksheet on calculations within a monopoly market scenario.

5.15. Oligopoly markets

Another example of an imperfect market is an oligopoly. An oligopoly may be defined as ‘a market in which a few firms dominate by virtue of being the major suppliers of a commodity for which there are no substitutes’.

In this market structure analysis the following assumptions are made:

- There are only two, equally-sized, suppliers, although in practice a market with a few dominant players (above 35% market share) will often exhibit oligopolistic tendencies.

- There is one, homogeneous product and no substitutes are available.

- Both suppliers aim to maximise profit.

An oligopolistic style of market is often found with the bulk chemical industry.

Exercise

Browse the internet using the key word ‘oligopoly market model’. Make your own notes on what you find.

5.16. Oligopoly market analysis

Download this presentation on oligopoly markets and use the guide below to explore about their analysis.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- The starting point of this analysis is a graph of the cost curves facing one of the many companies in a perfect market (see Perfect markets). The graph shows the marginal cost curve for the company and as it will be price taker (in a perfect market) it will face a constant demand curve at price p1. The marginal revenue MR curve is identical to the demand curve.

- However, in this oligopoly analysis there are only two main suppliers, call them company A and company B. Each of these companies may not be ‘price setters’ as in a monopoly but will have a big influence on the price of the product in the market and the price set by each other.

- Consider the demand curve for company A’s product. This will be influenced by the price of company B’s product.

- In one scenario assume that company A always charges the same price as company B, in which case the demand curve D1 will be downwardly sloping (click 1), although currently the price has not changed at p1.

- In another scenario assume that company B will always charge price p1 whatever price company A charges, in which case the demand curve will be D2 (click 2). This is because if company A lowers its price but company B keeps a higher price then company A will sell more product and the demand will be higher. However, if company A raises its price but company B keeps a lower price then company A will sell less product and the demand will be lower.

- Each demand curve D1 and D2 will be associated with different marginal revenue curves MR1 and MR2 respectively (click 3).

- Assume that whatever price is charged by company A it will always assume the worst, ie that company B will always follow a price cut but not a price rise. In which case the demand curve facing company A will be kinked (click 4) because for all prices below p1 curve D2 will be followed but for all prices above p1 curve D1 will be followed. Consequently there will be a stepped marginal revenue curve (click 5) as below p1 MR2 will be followed and above p1 MR1 will be followed.

- An identical analysis for the demand and marginal revenue curve facing company B will apply.

- The consequence of the kinked demand curve and stepped marginal revenue curve can be seen when the profit maximisation point at MC = MR is determined. Marginal cost curve MC1 intersects the stepped marginal revenue curve within the disjuncture (click 6). The profit maximising price is p1 and quantityq1. Marginal cost curve MC2 also intersects the stepped marginal revenue curve within the disjuncture (click 7), hence the profit maximising price is also p1 and quantity alsoq1.

- So there can be a wide fluctuation in the marginal costs and the profit maximising price and quantity will remain at p1 and q1. Within an oligopoly market once this price and quantity become stabilised then they can remain constant over long periods of time as the costs fluctuate. If the marginal costs change significantly such that the MC curve intersects the stepped MR curve away from the disjuncture then there may be a flurry of price changes until after a while the price stabilises again at a new price level within a different MR step.

Exercises

- Make a list of markets you judge are oligopolies or oligopolistic in style, search the internet to help you identify some examples, especially within the chemical and pharmaceutical fields.

- Test your understanding of the oligopoly market model by working through the calculations on this worksheet.

5.17. The cartel market model

The word ‘cartel’ is derived from the German/Dutch ‘Kartel’ meaning company associations. A cartel may be defined as ‘all sellers of a homogeneous good in a market are members of a trade association which fixes a common price for the good’.

Exercise

Browse the internet using the key words ‘cartel market’. Make your own notes on what you find.

A cartel is an illegal market practice in most countries and severe penalties may be awarded to those found guilty of operating a cartel. However, the potential financial rewards for participants are high, which makes this practice very tempting to follow.

5.18. Cartel market analysis

Download this Powerpoint presentation to learn about the behaviour and analysis of cartel markets, using the accompanying guide below.

Presentation guide

Start the presentation and click when prompted (see Using presentations in this resource).

- The starting point of this analysis is a graph of the demand and supply curves for a whole perfect market (see Perfect markets). The graph shows the downwardly sloping demand curve and upwardly sloping supply curve (consisting of a horizontal summation of individual companies marginal cost curves). The equilibrium price is at p1 and the equilibrium quantity is at q1.

- The lower graph shows the marginal cost curve for an individual company and as it will be a price taker in a perfect market it will face a constant demand curve at price p1 (click 1). The marginal revenue MR curve is identical to the demand curve. Hence the profit maximisation position for an individual company is where MC = MR at quantity x1 (click 2).

- Companies operating in this market may look at these two graphs and realise that if they could work together (as a cartel) and set a common price for the product, without worrying that the competition will undercut with lower prices, then they could be an effective Monopoly. If this was the case then instead of being individual ‘price takers’ the companies within the cartel could become ‘price setters’ and operate around the whole market demand curve, which will have a associated marginal revenue MR curve and a profit maximisation at price p2 and market quantity q2 (click 3). In other words, every member of the cartel would obtain a higher price for their product. There is a strong economic incentive to set up a cartel to the detriment of customers who will have to pay a higher price for their product.

- However, the cartel will have limited control over the demand curve, which is determined by the response of customers. Therefore in order to keep the demand equation in balance the cartel as a whole must supply the market quantityq2. The only way of doing this is if the cartel members get together, not just to set a common price, but also to share out the available quantity to supply between them. Once they have done this each company will then be expected to supply its quota of product into the market.

- Assume that one company within the cartel is allocated a quantity x2 to supply. For them they are now faced with an individual demand curve D2 and supplying quantity x2 at a set price of p2 (click 4). In other words they are now a price taker, albeit at the common higher cartel price to which they have agreed.

- However, this individual cartel member would like to maximise its profits by setting MC = MR, which is at price p2 and quantity x3, which is a higher quantity than x2 (click 5). Hence this company faces a dilemma, to supply the lower quantity agreed with its fellow cartel members or to supply the higher quantity to maximise its own profits. The cartel agreement will only work economically if the overall market supply is kept at q2. So the individual company has a big financial incentive to cheat on the cartel and sell more that agreed.

- An individual company may get away with cheating on the cartel if no one else finds out and the extra quantity sold is not large in relation to the whole market. However, the consequences of being found out usually means that the cartel will disintegrate, all price agreements are now void and the market returns to a competitive perfect situation with lower prices.

- However, once the competitive market has returned there is now a financial incentive to re-form the cartel and the cycle can start again of forming and breaking up.

- As cartels are an illegal trading practice there are many reasons why a cartel will break up, including one member whistle blowing on the others.

Exercise

Search the internet to find as many examples of chemical and pharmaceutical companies who have been investigated or proven to be involved with operating a cartel. Find answers to the following two questions:

- What legal penalties may be applied to a company and company staff found guilty of operating a cartel?

- What often happens to whistle blowers from within a cartel?

5.19. Accounting and finance

Financial management and control is important because:

- Companies must operate profitably.

- Failure to control expenditure or to ensure adequate income could render the company insolvent.

- In order to operate effectively financial targets must be set.

- There is a legal requirement to comply with accepted accountancy conventions and systems.

- Directors have an overall responsibility to their shareholders for the financially sound operation of the company and must publish an Annual Report and be subject to the scrutiny of external and internal auditors.

- Shareholders are the owners of the company.

- They elect a Board of Directors to run the company.

- They approve the strategic plans which the directors propose.

- Directors issue an Annual Company Report and give an account of their performance at the Annual General Meeting of Shareholders.

- Shareholders may receive dividends on their shares from distributed profits and may have a capital gain in the market value of their share increases but they can also have losses from selling their shares.

- Shareholders can initiate the liquidation of the company and receive back the nominal value of their shares or whatever is left after short-term or long-term creditors have been paid.

- Thus in the end the Shareholders have financial control over a company but it is the Directors and Managers who are responsible to the shareholders for executing the necessary financial management and control of the detailed company affairs.

Annual Reports have to be published by all limited companies as required by the Companies Act.

Company Accounts should contain the following sections:

- Directors’ Report

- Balance Sheet

- Profit and Loss Account

- Cash Flow Statement

- Notes on the Accounts

- Auditor’s Report

Some useful accounting terms

- Share capital – the permanent capital of the business comprises ordinary shares (equity) and preference shares

- Reserves – composed of retained profits, long-term liabilities of bank loans, mortgages and debentures

- Current liabilities – due for payment within one year and composed of short-term bank loans, current tax, trade creditors and the liability to pay current dividend

- Fixed assets – permanent assets used to provide good and services including properties, fixtures and equipment

- Current assets – have an expected tie span on no more than one year including cash and material that can be readily converted into cash eg stocks and trade debtors

- Depreciation a provision made as a charge on profits for the value of a fixed asset, if depreciation is not charged to the accounts then profits will be reported too highly and the net book value of fixed assets will be too high

Hear from a management accountant

Exercises

- Watch this video on the language of business, which provides a good background to accounting and finance.

- Watch this series of video lectures on the principles of accounting and make notes on each of the main topics (you can explore further lectures if you wish):

- Watch this video series from ORU, covering a course in accounting principles:

- Browse the accounting tutorials on SimpleStudies and make your own notes on what you find.

5.20. What is a profit and loss account?

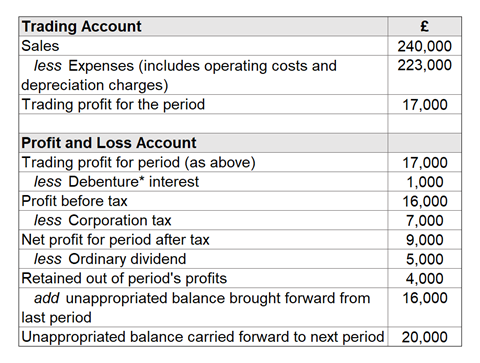

A profit and loss account (or statement) summarises the revenue and expenses of the business for an accounting period. It shows tax charged against profit and the extent to which after-tax profits are paid back as dividends (distributed) or retained in the business (ploughed back).

Example: Acme Chemicals

* ‘Debenture’ is a form of company debt, a bond bearing a fixed rate of interest payable whether the company makes a profit or not.

Exercise

Watch this video about a profit and loss account. Make your own notes on what you find.

5.21. What is a balance sheet?

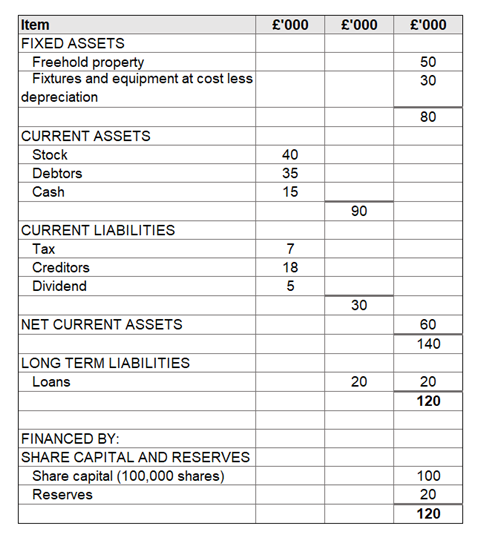

A balance sheet is a classified summary as at a particular date showing the sources of funds controlled by a business and how it has used these funds.

Example: Acme Chemicals

Note that the value of the net assets of the company (£120,000) is balanced by how they have been financed (£100,000 from shareholders and £20,000 from previous company profits).

Exercise

Explore the following resources about balance sheets and make your own notes on what you find:

- What is a balance sheet? (video)

- Profit and loss account and balance sheet (video)

- How to prepare a balance sheet (tutorial)

- A balance sheet example (video)

5.22. What is a cash flow statement?

A cash flow statement shows the major changes in the accounting period in the funds which a company controls.

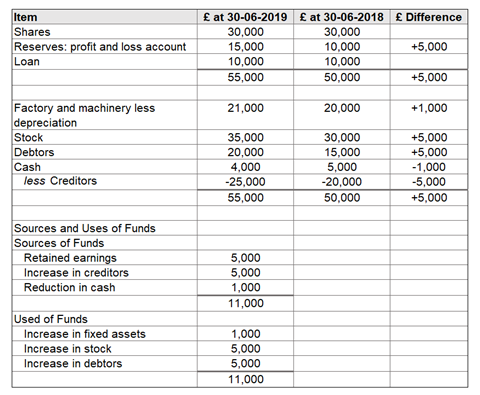

Example: Ebor Chemicals

Exercises

- Watch the following videos about cash flow statements and make your own notes on what you find:

- Browse the corporate websites of chemical and pharmaceutical companies and find their latest Annual Reports. Locate their balance sheet, profit and loss account and cash flow statements and try to identify the items listed above in the examples. Are they profitable? Have they issued shares or taken out a large bank loan recently in order to finance a major investment or takeover of another company?

5.23. Analysing company accounts

There are several different accounting methods for analysing a company’s financial statements, including vertical analysis, horizontal analysis and ratio analysis.

Vertical analysis

In this method, all figures in the accounts are converted to percentages of the relevant total or sub-total to aid comparison and perspective.

Horizontal analysis

This compares performance between years and between companies. It helps managers to determine which financial components are out of line.

It is important to compare like with like.

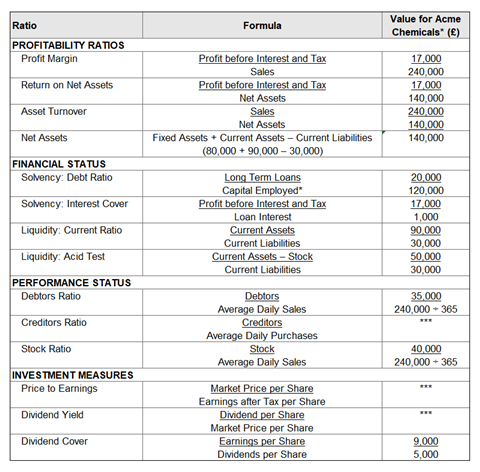

Ratio analysis

This compares figures from different sections of the accounts. It involves calculating financial ratios, looking for trends in these ratios and comparing them with average values for other companies in the same industry. The following ratios are commonly used:

*Capital employed = Share capital + Loans = 100,000 + 20,000 = 120,000

Exercise

Review this topic and find out more with this series of video talks on finance and accounting by entrepreneur Lisa Newton.

5.24. Corporate finance

Corporate finance is about how an organisation raises finance to support its activities and how it manages the money raised effectively and efficiently.

Finance is available from many sources:

- Shareholders in the form of share capital (company pays dividends)

- Banks and other financial institutions in the form of loans, short and long-term (company pays interest)

- Investors in the form of corporate bonds (company pays back the capital on an agreed date as stated in the bond and interest throughout the lifetime of the bond)

- Governments in the form of grants and tax reliefs

- Wealthy individuals

- Retained profits from exiting business operations (for commercial organisations)

- Charitable donations (for charity/educational organisations)

Exercise

Explore the following videos and make notes on what you find:

- Finance: what managers need to know (Harvard Business Review)

- Overview of finance (Lipscomb University)

- Introduction to corporate finance (LSBF Global MBA)

5.25. Financial appraisal of projects

An important role for a manager within the chemical industry is to decide between different project options. An important factor to take into account when making these decisions is the financial aspects and to identify which project will return the most money for the company over the life time of the project.

There are many financial appraisal tools that can be used to help make these decisions and two are introduced here, payback period and discounted cash flow. In all cases it is necessary to predict future incomes and costs and profits for the project options, which is a risky but necessary activity (see Forecasting business trends).

Exercise

Watch this video on investment appraisal methods for an overview of financial appraisal.

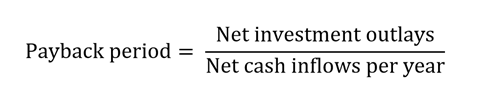

5.26. Payback period

The payback period has been widely used within the chemical industry and is basically how long it will take for the expected net cash inflows of a project to pay back the net investment outlays.

The decision is to select the project with the shortest payback period.

Example 1

A chemical company is considering the acquisition of automated drum filling equipment which will reduce labour costs. The following facts have been estimated:

- Net investment outlays: £200,000

- Estimated annual cash savings (after tax): £60,000

- Estimated useful life: 5 years

- Salvage value: nil

Payback period = £200,000 / £60,000 = 3.33 years

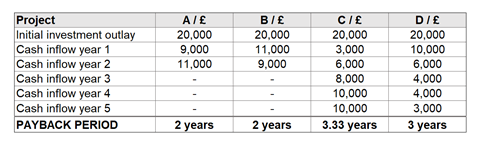

Example 2

A chemical company is considering four different investment projects each costing £20,000. Which project should be chosen?

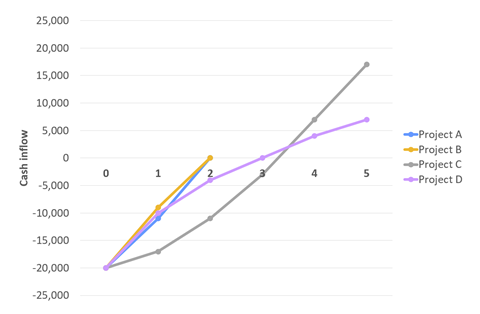

Project A and B have the shortest payback period so should be selected by the company. However, on detailed inspection it is noticed that whilst project C has the longest payback period it actually returns the most cash over five years as can be seen in the graph below.

This illustrates the disadvantage of using payback period in that cash flows which are returned after the payback period are not counted.

Advantages of payback period

- Simple to calculate

- Easy to understand

- Good comparison for projects of equal duration and similar complexity

Disadvantages of payback period

- Ignores all cash flows after the payback period

- Does not take risk into account therefore will often select a risky fast payback project over a safe slower project.

- Ignores the time value of money (see the next section on discounted cash flow below)

Exercise

Browse the internet using ‘payback period’. Make your own notes on what you find.

5.27. Discounted cash flow

Discount cash flow is a widely used technique to determine the financial feasibility of a long-term project, such as the building of a chemical plant.

Forecasting techniques may be used to predict the incomes and costs of the products manufactured. However, one problem with a long-term project is concerned with the time value money.

Basically, if you have £1000 in your pocket today and you leave it there then it will still be worth £1000 in a years time. But if you invest the £1000 in a bank at 10% interest then after a year you will have £1100 and after two years you will have £1210.

So time erodes the value of money and the compound interest formulae can be used to calculate how much money will be worth in the future at a given rate of interest.

Exercises

- Download this presentation on discounted cash flow to find out more about key related topics, including the time value of money, net present value (NPV) and internal rate of return (IRR).

- Browse the internet using the terms ‘discount cash flow’, ‘net present value’ and ‘internal rate of return’. Make your own notes on what you find.

- Watch the following videos on discount cash flow:

The project with the highest positive NPV is the project that should be selected from a financial point of view. A positive NPV means that the project will return more cash than would be the case if the investment was put into a bank at the discount rate of interest.

Advantages of discount cash flow

- Includes the time value of money

- Clear choice criteria

- An absolute measure

Disadvantages of discount cash flow

- Complex to calculate (although easy by computer) and difficult to forecast data far in the future

- Difficult to relate to the financial accounts because only cash items should be considered within a DCF whereas accounts contain non-cash items such as depreciation

Exercise

Watch the following video lectures from RCA Belfast summarising investment appraisal techniques:

5.28. Summary exercises

Demand and supply curves calculation

Download this worksheet to practise calculations relating to demand and supply, drawing together material from Cost equations and Perfect markets.

Launching lemon bleach: calculating costs

In this exercise, you will use published cost information from catalogues and other sources to build up a cost estimate for an aliphatic nitrile fragrance component, based on the process chemistry described in the associated patent literature.

Find out more about the lemon bleach scenario used in this resource, or download the costing exercise now.

6. Ideas and intellectual property

Intellectual property (IP) is like the centre of a solar system, around which many aspects of business revolve, especially in the chemical industry.

IP is usually the result of a substantial investment in R&D over many years. With appropriate protection, IP can ensure returns on that investment, and that the business remains profitable.

This section gives an overview of the various types of IP, with a particular emphasis on patents, and how IP is managed. Chemists working on new products in R&D liaise with lawyers to maximize protection of the intellectual property they create, and it is crucial for them to understand each other.

6.1. Hear from a patent attorney

6.2. Types of intellectual property

Everywhere around you there are commercial goods that have different characteristics and are either functionally or visually different, while some of them merely have different brand names.

In most cases, there is something special about these goods that made you purchase it, and it is most likely that the manufacturer has protected this special feature to distinguish their products from competitors and thus gain economic advantage.

Knowing what types of IP protection are available to a company and their specifications can help to protect new development in its early stage, target product development to maximize IP protection, or to ensure that a new development does not infringe on other companies’ IP, which could result in lost investment and lawsuit charges.

Find out more

Read about trademarks, copyright and designs – three of the four main types of IP – on the website of the Intellectual Property Office, the UK’s official government body responsible for granting IP rights.

The primary and most rewarding form of protection applicable to the chemical industry is patent protection, explored in the next section.

The type of IP protection you need depends on what you’ve created and what you’ll use it for. Some products need all four!

The Intellectual Property Office

Exercise

Now that you know about different types of IP protection, do you think it is always beneficial to protect your idea or keep it as a trade secret? Explain your reasoning.

Launching lemon bleach: trademark design

You are aiming to launch a new range of household cleaners based on distinctive new bleach-stable aliphatic nitrile citrus fragrance components that you have been able to produce. Design a trademark for your ‘lemon bleach’ product line.

Find out more about the lemon bleach scenario used in this resource.

6.3. Patents: searching, reading and applying

Patents in the chemical industry are the most applicable and valuable form of IP protection that deters competitors and secures returns on the capital invested in R&D, which tends to be very costly, especially in the pharmaceutical industry. For academia, patents can be also a stable source of income to continue funding research, or could result in successful spinouts.

Before its benefit can be fully exploited, a patent needs to be applied for and granted. Given the purpose of the patent system, one should expect the procedure to be complicated, lengthy and costly. However, thorough understanding of the patenting procedure can help reduce the time and cost of the procedure and increase the benefits.

For this reason, your knowledge of the patent system can give you a competitive advantage as a job candidate, as well as to your employing company, where R&D ideas rely on patenting protection.

Find out more

The first and most important step in a patent application is to make sure that no one else has patented the same idea before, ie study the prior art. The main way to do this is to check existing patents in your area. Use this presentation on patent searching to find out where to look and how to search effectively.

Now, find any patent and try reading it. What do you think? Is it easy to read it? It is good to be able to read patents, and although they can seem confusing at first, there is a general structure to patents that makes it easier. Download this presentation identifying the key features of patents to learn how to read them.

Knowing how to read a patent will also help with drafting your own patent, since all patents conform to the same general structure. Last but not least, you need to be familiar with the patent application procedure of the region you wish your patent to be active in, since the procedure depends on the patent authority in your jurisdiction (although the variations are not major). This step-by-step patent guide from the UK government provides an overview of the patent process.

Launching lemon bleach: checking for patents

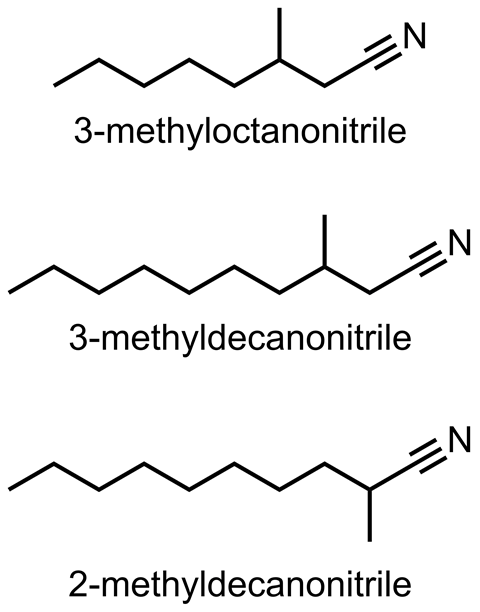

You have produced a range of distinctive citrus fragrance components for a new variety of bleach. The structures are shown below:

Search for patents relating to these molecules. What protection has been, or is, in place? Are there patents relating to production routes that might affect your intended manufacture? Is there any precedent in the patent literature for the use of these molecules in cleaning products?

6.4. Intellectual property management

Patent is property, like a house. And like with a house, there are a number of ways you could deal with it:

- Move in yourself (use your patent to provide commercial product)

- Rent it out to an individual (licence your patent for other company with technical capabilities to exploit your patent)

- Hire a property managing company to take care of it (hire a contractor company to manufacture your patented product with your full rights to the patent intact)

- Refurbish it into flats and rent it out to a number of individuals (licence your invention to a number of companies and collect fees from each of them)

The best option depends on the circumstances of the individual inventor. However, one thing is clear: deciding in favour of inaction is unwise, and a waste of money. Since there are a number of possibilities, what is the right or wrong decision is not clear cut.

Find out more

Read Ashish Arora’s article ‘Patents, licensing and market structure in the chemical industry’, in which the author gives a historical overview of patents, their role in global chemical development and how licensing and trade secrets shaped the industry.

6.5. Summary exercises

Launching lemon bleach: IP protections

In Types of intellectual property, you met the idea of designing a trademark for a ‘lemon bleach’ household cleaning product line, and you should have explored the IP landscape surrounding the fragrance chemicals you plan on using in Patents: searching, reading and applying.

In addition to your trademark, provide details of the full range of protection you could put in place for your product range (and covering the range of activity from production of the fragrance to marketing of the product range). In view of the processes and costs involved, which protection would you actually recommend putting in place?

Reflections of a patent/trademark attorney

The background of fragrance chemistry provides an interesting perspective on patents and trademarks. Patent/trademark attorney Tony McStea began life as a graduate chemist in the patent division at Dulux Australia (paints) before moving through ICI and various divisions of European chemical giants Novartis and BASF to the leading flavour and fragrance company Givaudan.

Read McStea’s reflections on patents and trademarks to find out more.

7. Regulations

The chemical industry is one of the leaders across the world in terms of generated revenue, extent of trade and number of jobs. For over a century it has helped to shape the modern world, and it has an important role to play in addressing a number of the challenges we face today, from depleting natural resources to maintaining the health of a growing and aging population.

It is crucial that the chemical industry approaches these challenges with the health and safety of the public and its workforce as a priority, while also preserving the natural environment. These priorities govern the legislative framework that the industry operates in.

This section gives an overview of the regulations to which the chemical industry must adhere, focusing on the EU and the UK.

7.1. Hear from an industry expert

7.2. International regulations

The chemical industry is one of the most heavily regulated industries. The regulatory framework governing it has undergone drastic changes in recent years for a number of reasons: to protect human health and the environment by addressing emerging toxicity data, and to improve the sustainability of the industry to address shortage of resources and climate change.

The history of the chemical industry has also seen a number of devastating accidents that led to stringent rules and regulations to prevent these and similar incidents from happening again. With improving understanding of the harm chemicals can cause, changing manufacturing methods and growing demand due to emerging economies, regulations in the chemical industry are continuously changing.

In order for businesses to stay successful and profitable, they not only have to comply with current rules and regulations, but should also monitor trends to prepare for future changes. Most of the existing laws and regulations are the result of the evolving legislative framework over decades and decades of the industry’s history. However, there is a multi-level hierarchy of rules set and followed by different bodies.

Throughout this section on regulations, this hierarchy is broken down to three levels:

- The international level, ie the UN

- The regional level, ie the EU

- The national level, ie the UK

We will cover how these different levels of regulation influence operations of a business that manufactures or handles chemicals.

Find out more

On the international level, there are global problems that need to be addressed by all of the nations in order to tackle them effectively. That is why many countries decide to come together to reach agreements and to set up initiatives that are mostly very ambitious, far reaching and to a large extent cannot be immediately implemented.

However, these initiatives can set up a course of movement for the governments and the industry, thus influencing changes to the regulatory framework in the future.

Search the internet to familiarise yourself with some of the international agreements and initiatives that have shaped the chemical industry in recent decades, including the Marrakech Process, the Basel Convention, the Rotterdam Convention and the Strategic Approach to International Chemicals Management (SAICM).

You may also be able to find relevant information on the European Chemical Industry Council (CEFIC) website.

7.3. Regional regulations

In the previous section, you learned about the existence of international initiatives for regulating the chemical industry, and familiarized yourself with some of the initiatives and conventions. The next level of the regulational hierarchy that will be discussed here is almost completely unique to the EU.

The EU decides on the directives that all member states should incorporate into their national legislative frameworks. Nowhere else in the world does such a large group of developed countries have to commit to a uniform legislative and economic framework for their chemical industries.

The main goal of this system is to enable trade and facilitate safety. It must be said that, to date, EU regulation of the chemical industry is the most demanding globally, with the greatest priority given to the safety of the consumer and the environment.

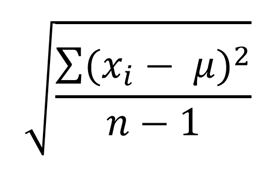

Registration, Evaluation, Authorisation and Restriction of Chemicals (REACH)